Retirement Strategies

Debunked: Myths About Retirement…Which Retirement Myth Is Killing Your Financial Security? Don’t Put Your Golden Years At Risk!

How much do I need to retire?

Fidelity's rule of thumb: Save 10x your income by age 67

Key takeaways

- Fidelity's rule of thumb: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

- Factors that will impact your personal savings goal include the age you plan to retire and the lifestyle you hope to have in retirement.

- If you're behind, don't fret. There are ways to catch up. The key is to take action.

How much do you need to save for retirement?

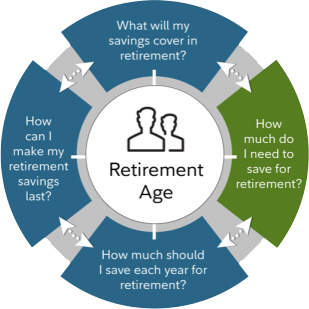

Learn more about our 4 key retirement metrics—View Larger Image.

Note – a yearly savings rate, a savings factor, an income replacement rate, and a potentially sustainable withdrawal rate—and how they work together in the Viewpoints Special Report: Retirement roadmap.

It's one of the most common questions people have. There are so many imponderables: When will you retire? How much will you spend in retirement - and for how long?

That's why we did extensive analysis to come up with age-based retirement savings factors that can help you plan—despite those uncertainties. These milestones are aspirational. You likely won't meet all of them. But they can serve as goalposts to help you make a plan to save enough to maintain your lifestyle in retirement.

Our savings factors are based on the assumptions:

- That a person saves 15% of their income annually beginning at age 25.

- Invests more than 50% on average of their savings in stocks over their lifetime.

- Retires at age 67 and plans to maintain their preretirement lifestyle in retirement (see footnote 1 for more details).

Based on those assumptions, we estimate that saving 10x (times) your preretirement income by age 67, together with other steps, should help ensure that you have enough income to maintain your current lifestyle in retirement.

That 10x goal may seem ambitious. But you have many years to get there. To help you stay on track, we suggest these age-based milestones:

- Aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60.

- Your personal savings goal may be different based on various factors including 2 key ones described below.

- These rules of thumb can provide a starting point to help your build your savings plan, and assess your progress.2,3

1. When You Plan To Retire

The age you plan to retire can have a big impact on the amount you need to save, and your milestones along the way. The longer you can postpone retirement, the lower your savings factor can be. That's because delaying gives your savings a longer time to grow, you'll have fewer years in retirement, and your Social Security benefit will be higher.

Consider some hypothetical examples (see graphic).

Max plans to delay retirement until age 70, so he will need to have saved 8x his final income to sustain his preretirement lifestyle.

Amy wants to retire at age 67, so she will need to have saved 10x her preretirement income.

John plans to retire at age 65, so he would need to have saved at least 12x his preretirement income.

Of course, you can't always choose when you retire—health and job availability may be out of your control. But one thing is clear: Working longer will make it easier to reach your savings goals.

See footnote at the end of the article for more information.1

2. How You Want To Live In Retirement

In other words, do you expect your expenses to go down when you retire? We call that a below average lifestyle. Or will you spend as much as you do now? That's average. If you expect your expenses will be more than they are now, that's above average.

Let's look at some hypothetical investors who are planning to retire at 67.

Joe is planning to downsize and live frugally in retirement, so he expects his expenses to be lower. His savings factor might be closer to 8x than 10x.

Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x.

Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

Take stock

Our simple widget lets you see the impact of these 2 variables—when you plan to retire and what kind of lifestyle you want to live in retirement—on how much you need to have saved when you do retire, and on all the intermediate milestones.

What if you're behind? If you're under age 40, the simple answer is to save more and invest for growth through a diversified investment mix. Of course, stocks come with more ups and downs than bonds or cash, so you need to be comfortable with those risks.

If you're over 40, the answer may be a combination of increased savings, reduced spending, and working longer, if possible.

No matter what your age, focus on the goals ahead. Don't be discouraged if you aren't at your nearest milestone—there are ways to catch up to future milestones through planning and saving.

The key is to take action, and the earlier the better.

Contact us to discuss your retirement planning.

*Mutual funds distributed through Desjardins Financial Security Investments Inc.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

1. Fidelity has developed a series of salary multipliers in order to provide participants with one measure of how their current retirement savings might be compared to potential income needs in retirement. The salary multiplier suggested is based solely on your current age. In developing the series of salary multipliers corresponding to age, Fidelity assumed age-based asset allocations consistent with the equity glide path of a typical target date retirement fund, a 15% savings rate, a 1.5% constant real wage growth, a retirement age of 67 and a planning age through 93. The replacement annual income target is defined as 45% of pre-retirement annual income and assumes no pension income. This target is based on Consumer Expenditure Survey (BLS), Statistics of Income Tax Stat, IRS tax brackets and Social Security Benefit Calculators. Fidelity developed the salary multipliers through multiple market simulations based on historical market data, assuming poor market conditions to support a 90% confidence level of success.

These simulations take into account the volatility that a typical target date asset allocation might experience under different market conditions. Volatility of the stocks, bonds and short-term asset classes is based on the historical annual data from 1926 through the most recent year-end data available from Ibbotson Associates, Inc. Stocks (domestic and foreign) are represented by Ibbotson Associates SBBI S&P 500 Total Return Index, bonds are represented by Ibbotson Associates SBBI U.S. Intermediate Term Government Bonds Total Return Index, and short term are represented by Ibbotson Associates SBBI 30-day U.S. Treasury Bills Total Return Index, respectively. It is not possible to invest directly in an index. All indices include reinvestment of dividends and interest income. All calculations are purely hypothetical and a suggested salary multiplier is not a guarantee of future results; it does not reflect the return of any particular investment or take into consideration the composition of a participant’s particular account. The salary multiplier is intended only to be one source of information that may help you assess your retirement income needs. Remember, past performance is no guarantee of future results. Performance returns for actual investments will generally be reduced by fees or expenses not reflected in these hypothetical calculations. Returns also will generally be reduced by taxes.

2. The 45% income replacement target assumes a retirement and Social Security claiming age of 67, which is the full Social Security benefit age for those born in 1960 or later. For an earlier retirement and claiming age, this target goes up due to lower Social Security retirement benefits. Similarly, the target goes down for a later retirement age. For a retirement age of 65, this target is defined as 50% of preretirement annual income, and for a retirement age of 70, this target is defined as 40% of preretirement income. As the income multiplier target is based on income replacement target and retirement age, for an earlier retirement age, this target goes up due to lower social security retirement benefits and a longer retirement horizon. Similarly, the target goes down for a later retirement age. For a retirement age of 65, this target is defined as 12x and for a retirement age of 70, this target is defined as 8x.

3. Fidelity analyzed the household consumption data for working individuals age 50 to 65 from Consumer Expenditure Survey, US Bureau of Labor Statistics. The average income replacement target of 45% is based on the objective of maintaining a similar lifestyle to before retirement. This target is defined at 35% for "below average" lifestyle and 55% of preretirement income for "above average" lifestyle. Therefore, the final income multiplier target of 10x the final income goes down to 8x for 'below average' lifestyle and increases to 12x for 'above average' lifestyle. See footnote 1 for investment growth assumptions.

Retirement savings factors are hypothetical illustrations, do not reflect actual investment results or actual lifetime income, and are not guarantees of future results. Targets do not take into consideration the specific situation of any particular user, the composition of any particular account, or any particular investment or investment strategy. Individual users may need to save more or less than the savings target displayed depending on their inputs retirement age, life expectancy, market conditions, desired retirement lifestyle, and other factors.

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

738991.7.3

TFSA/RRSP

How Your Tax Bracket Decides Whether A TFSA Or RRSP Contribution Is Best ...And Why Your Tax Bracket In Retirement Is Also Key!

by John De Goey, Feb 25 2019

I was a bit surprised to learn recently that TFSAs had just ‘turned ten’. It seems like just yesterday that I was answering questions from the media about how these newfangled government-sponsored programs might change the landscape for investing in general and retirement planning in particular. Former Minister of Finance Jim Flaherty sang the praises of the new program a decade ago by stressing the ability to avoid paying tax when using TFSAs. Many pundits weighted in expressing regret that the third word was “savings” and not “investing”. In actuality, the program is used primarily as a tax-free investing account, so perhaps TFIA would have been a better moniker.

Irrespective of what people thought TFSAs might mean when they were first introduced, there is no denying that they have been wildly popular and broadly embraced by Canadians of all walks of life. Now that RRSP season is upon us (the deadline for 2018 is March 1, 2019), many people wonder if they should contribute to their RRSP or their TFSA since most people don’t have enough money to maximize both options. If you can only do one of the other, which makes more sense? Assuming we’re talking about retirement money, the answer depends on two things: your marginal tax rate in 2018 and your marginal tax rates in your retirement years. Let’s begin with the federal tax brackets. They are:

Income range Marginal tax rate

On the first $47,630 - 15.0%

Over $47,630 up to $95,259 - 20.50%

Over $95,259 up to $147,667 - 26.00%

Over $147,667 up to $210,371 - 29.00%

Over $210,371 - 33.00%

The large majority of Canadians are in either the first or second bracket (i.e., most Canadians make less than $95,000 a year). What follows is an exercise that works in moving between all brackets, but, for the sake of simplicity, will be illustrated in moving between the second bracket (between $47,630 and $95,259) and the first (under $47,630).

From an after-tax perspective, most people would likely be indifferent between an RRSP and a TFSA. That’s because most people are in the same tax bracket when working and when retired. When comparing RRSPs and TFSAs, remember that the former gets you a deduction on the way in (i.e., when contributing), but is taxable on the way out (i.e., when making a withdrawal). As a result, the tax consequences are a bit like the old Fram auto filter commercials—“you can pay me now, or you can pay me later”. Perhaps I’m dating myself.

Financial planners often tell their clients that they will likely have a retirement income that is less than two-thirds of what their working income was. For purposes of our example, let’s say we’re talking about someone who made $60,000 a year in 2018 and took a somewhat standard approach of saving 10% of their income for retirement. Putting $6,000 aside is a good thing to do and choosing one account over another is still far more fruitful than choosing not to save anything (perhaps on the flimsy pretence that you can’t decide which government-sponsored program to use).

If the person in the example was to earn more than $47,630 in retirement, that person should be indifferent between an RRSP and a TFSA, because the tax-deferred compounding in the former (deduction on the way in, tax on the way out) would be exactly equal to the tax-deferred compounding in the latter (no deduction on the way in; no tax on the way out).

Most people earn less in retirement while maintaining a similar standard of living due to having put their children through school, paid off the mortgage and so forth. As a result, it is not uncommon for someone who was earning $60,000 a year while working to earn less than $40,000 a year in retirement. Such a person would be in a position to benefit from ‘tax bracket arbitrage’ by using an RRSP. Such a person could get a deduction of 20.5% ($1,230) now while paying tax on a $6,000 withdrawal ($900) years later.

Remember that there are provincial tax brackets, too, but to be as simple and generic as possible, we’re just looking at federal rates here. While many people have no strong opinion when choosing between RRSPs and TFSAs, there is a clear advantage to RRSPs for those people who have more than modest incomes that are likely to be a fair bit lower in retirement. For most people earning over $47,000 a year, therefore, RRSPs are likely to be the better option.

John J. De Goey, CIM, CFP, FELLOW OF FPSC™ (the author) is a registrant with Wellington-Altus Private Wealth Inc. (WAPW). WAPW is a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). The opinions expressed herein are those of the author alone and do not necessarily reflect those of WAPW, CIPF or IIROC. Investors should seek professional financial advice regarding the appropriateness of investing in any investment strategy or security and no financial decisions should be made solely on the basis of the information and opinions contained herein. The information and opinions contained herein are subject to change without notice.

Contact us to understand the benefits of a TFSA

*Mutual funds distributed through Desjardins Financial Security Investments Inc.

As a financial planner at DFSIN and DFSI, I look forward to meeting you and understanding your goals and needs.

As a professional in the field of insurance and investments, my understanding of people's goals and aspirations has created a lasting bond over two decades. The key to their success has been my passion for excellence.