Annuities

What Are Annuities?

An annuity is a financial product that provides you with a guaranteed regular income. Typically, it is used during your retirement years and sold by an annuity provider, such as a life insurance company.

How annuities work

You can buy an annuity with a lump sum or through multiple payments over time.

The income payments you receive from an annuity are a combination of 3 things:

- Interest

- A return of your capital and

- A transfer of capital from annuity holders who die earlier than statistically expected to those who live longer than expected

You can choose to either receive income payments for a fixed period or for as long as you live.

Depending on the type of annuity you choose, you can receive income payments at different frequencies:

- Monthly

- Every three months

- Every six months or

- Once a year

You can choose to start receiving your payments right away, or at a later date if you bought a deferred annuity.

The amount of the regular income payment you get depends on a number of things, such as:

- If you are male or female

- Your age and health when you buy the annuity

- The amount of money you invest in the annuity

- The type of annuity you buy

- Whether you have the option to continue payments to a beneficiary or your estate after you die

- The length of time you want to receive payments

- The rates of interest when you buy your annuity

- The annuity provider

Types of annuities

There are many kinds of annuities. It’s important to understand each type of annuity and what options, benefits and risks each type presents.

Before you buy an annuity, you need to decide:

- Whether or not you want the annuity to continue to be paid to a beneficiary after you die

- Whether you want regular income payments or income payments that will increase or decrease regularly

Life annuity

A life annuity provides you with a guaranteed lifetime income. For example, if you buy a life annuity for $100,000 at age 65 with an income of $500 per month, you get your $100,000 back by age 82. If you live past 82, you will still receive $500 a month as long as you live.

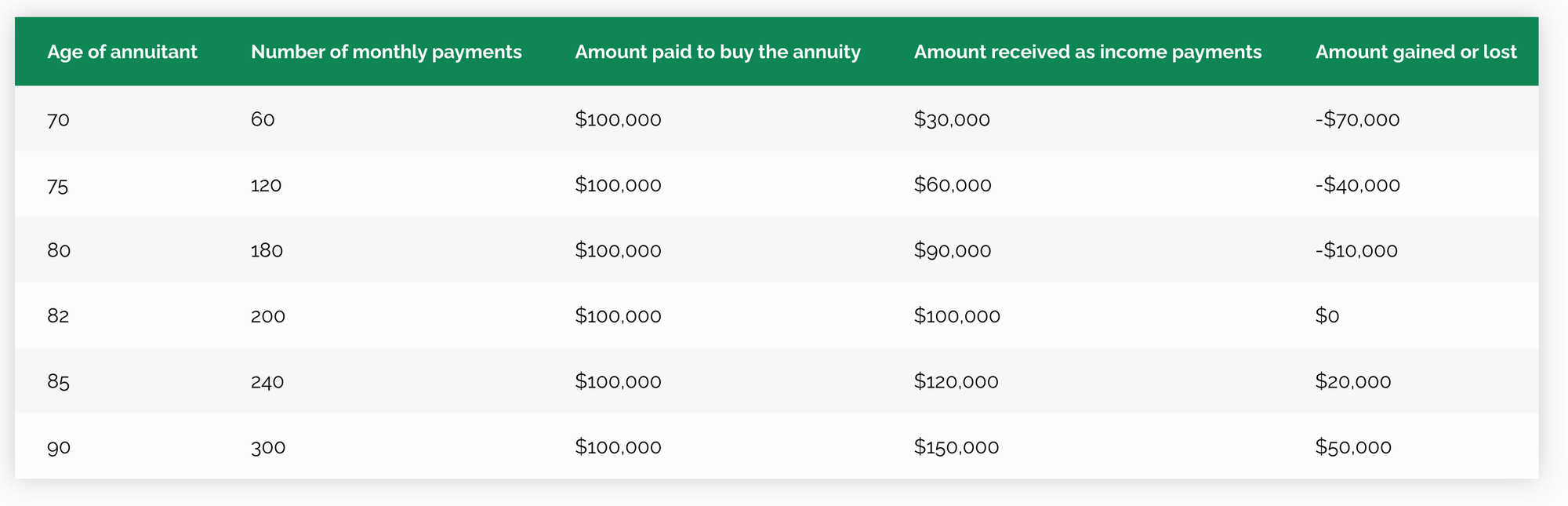

Table 1: Example of a life annuity with a $500 monthly payment starting at age 65

As this table shows, the longer you live, the more income your annuity provides.

In most cases, your life annuity payments stop when you die. No money goes to your estate or named beneficiary.

However, some annuity providers offer the following options so that payments continue after you die:

- A joint and survivor option: income payments continue as long as one of the annuitants is alive

- A guarantee option: income payments continue to be paid to a beneficiary or your estate if you die within a specific amount of time

- A cash-back option: provides a one-time payment to a beneficiary or your estate if you die before receiving a specific amount of money (usually the amount you paid for your annuity)

You can combine these options, but each additional feature will lower the amount of your income payment.

Term-certain annuity

A term-certain annuity provides guaranteed income payments for a fixed period of time (term). If you die before the end of the term, your beneficiary or estate will continue to receive regular payments. They may also receive the balance of the regular payments as a lump-sum.

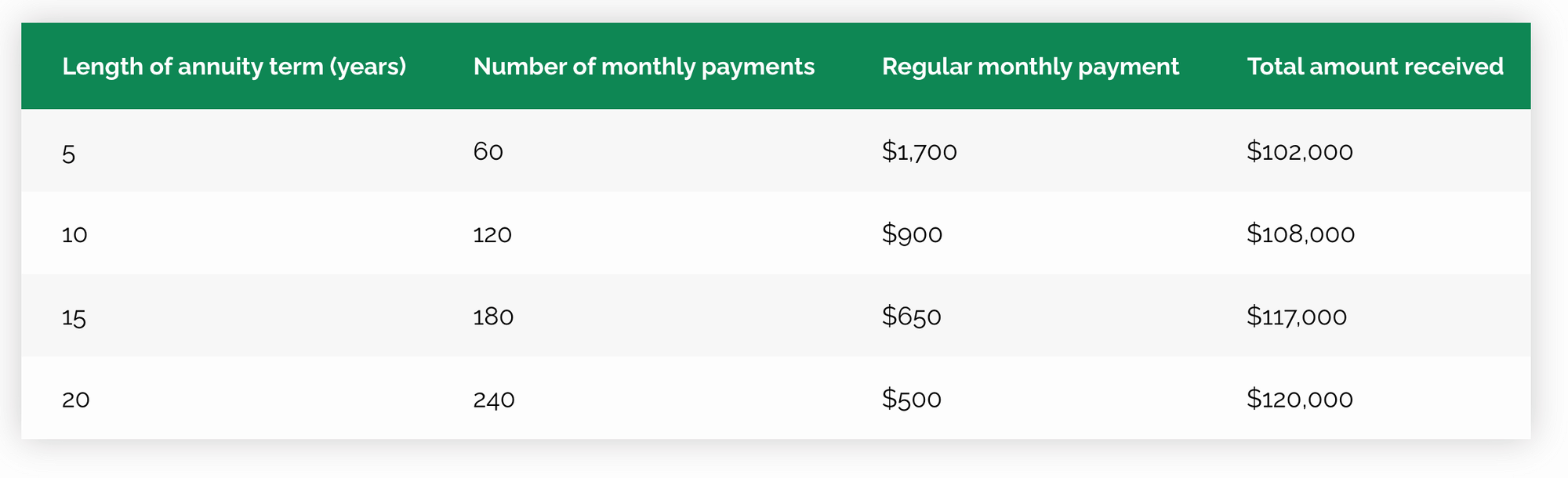

Table 2: Example of a $100,000 term-certain annuity with various lengths

Variable annuity

A variable annuity is when the provider invests your money in products with a variable return, such as equities. You receive a fixed income and a variable income. The fixed income portion is usually lower than what you would earn with a non-variable annuity, such as a life or term‑certain annuity.

The variable portion you receive will vary based on the performance of the investment. This means you could earn more money if the investments perform well, and less money if they perform poorly. This is different from a non-variable annuity where you get guaranteed income payments regardless of changes in the market.

Comparing different types of annuities

Annuities offer different options, pay close attention to the pros and cons of each.

Life annuity

A life annuity provides you with a guaranteed lifetime income.

The pros and cons include:

Pros

- Guaranteed income payments for as long as you live

- No risk of outliving your income

- Additional joint and survivor option to transfer payments to your spouse/partner

- Additional options to provide money to your beneficiary or estate when you die

Cons

- You may pass away before receiving all of your money back

- Adding extra options usually means a lower regular payment (such as providing payments to your spouse when you die)

Term-certain annuity

A term-certain annuity provides guaranteed income payment for a fixed period of time.

The pros and cons include:

Pros

- Guaranteed income for a set period of time

- Your beneficiary or estate will receive any remaining benefit if you die before the end of the term

Cons

- You may live longer than the term of your annuity, meaning you could stop receiving income before you die

Variable annuity

A variable annuity is when the provider invests your money in products with a variable return, such as equities.

The pros and cons include:

Pros

- Fixed income plus potential extra income linked to market performance

- You may earn more money than a non-variable life annuity if the investments backing the variable portion of your annuity perform well

Cons

- Your regular income is harder to predict

- You may earn less money than a non-variable life annuity if the investments backing the variable portion doesn’t perform well

What to consider before buying an annuity

Before buying an annuity, take the following into consideration.

When to buy an annuity

The best time to buy depends on your personal income needs and sources of income.

For example, you may want more money early in your retirement to pay for travel or new hobbies. Or you may want more guaranteed income later in your retirement to pay for health care costs or accommodations.

If you want more money later you could consider waiting to buy an annuity or buying a deferred annuity. This means that you pay for the annuity ahead of time but won’t start receiving payments right away. Deferred life annuities provide higher regular payments than immediate life annuities. This is because you will receive fewer payments during your life.

If you buy an advanced life deferred annuity with money from your employer pension plan or your registered retirement savings, certain tax rules apply in terms of age and amount limits.

Learn more about the tax rules for advanced life deferred annuities.

Your other sources of retirement income

Your retirement income may come from a number of places.

This may include:

- Employer pension plan or Pooled Registered Pension Plan ( PRPP )

- Registered savings, such as a Registered Retirement Savings Plan ( RRSP ) or a Tax-Free Savings Account ( TFSA )

- Public pensions and benefits, such as Old Age Security ( OAS ), Canada Pension Plan ( CPP ), or Quebec Pension Plan ( QPP )

- Personal savings and investments

Having an annuity can make it easier to create a budget and manage your money. It’s especially the case if you don’t have another regular source of retirement income.

However, an annuity may not be the best option for you if your regular income and savings will already cover your expenses when you retire. Speak with a financial professional to figure out whether you’ll have enough money for your needs when you retire.

The overall price you pay for an annuity can vary between providers

Annuity providers may offer you different income payments for the same type of annuity.

This is because providers calculate the amount of monthly income they can provide based on many factors such as:

- The type of your annuity (fixed or variable)

- The term of your annuity (life-only, joint life, term-certain)

- Your age and gender (so they can estimate your life expectancy)

- Their operating costs

- The return they expect to receive on their investments

Before buying an annuity, ask for the list of fees and commissions. Make sure you understand the contract restrictions, including penalties and administrative fees.

Once you know what kind of annuity you are interested in buying, compare similar products from several providers.

Whether you want to leave money to a beneficiary or your estate

You may decide that you want to leave money to your estate or a beneficiary when you die. If so, you could consider buying a term-certain annuity or a life annuity with either a joint and survivor option or a guaranteed payment period.

The annuity is not the only option. For example, you can also keep some money in another product, like a savings account, TFSA or RRIF.

You may lose money

You’ll receive more money from a life annuity the longer you live. However, you may not live long enough to get all of the money you paid to buy the annuity in the first place.

Annuities may require a large investment

You may need a large amount of money to buy an annuity. For example, many annuity providers may ask that you invest $50,000 or more to buy an annuity.

Tax implications on annuities

You'll have to report the money you get from an annuity as income when you file your taxes. You may have to pay tax on this money. The amount of tax you may pay will vary depending on the product. Taxes will be different if you buy your annuity using registered savings versus non‑registered savings.

How your annuity income is protected

Canadian life insurance companies have the obligation to be members of a consumer protection agency called Assuris. Assuris protects policyholders up to a certain amount if the annuity provider is unable to pay. You will then continue to receive at least some of your money if your provider goes out of business.

The income you receive from an annuity covered by Assuris is insured as follows:

- 100% for monthly payments up to $2,000

- 85% for monthly payments above $2,000

For example, if your regular annuity income is $1,500 per month, you will continue to receive the full amount. If your regular annuity income is $3,000 per month, then you will continue to receive 85% of this amount, or $2,550.

Changing or cancelling an annuity

When you buy an annuity, you enter into a contract with the annuity provider. Typically, once you buy an annuity, you can’t change the terms of the contract. This means you can’t switch to a different type of annuity or get your money back.

Your annuity contract may have a cooling-off period. This means that you can cancel the contract without a penalty within a specific amount of time. Be sure to read your annuity contract carefully to see if it includes a cooling-off period.

The contract may give the option to cancel within a certain time period after you start receiving payments. There is usually a fee to do this which can be a percentage of the purchase price.

Contact your annuity provider for more information about the contract and your rights to change or cancel an annuity.

If you are thinking about buying an annuity, speak with a financial professional. They can help you figure out what’s right for you, when to buy it and when to start getting payments.

Contact us to find out which annuity works best for you.

*Mutual funds distributed through Desjardins Financial Security Investments Inc.

As a financial planner at DFSIN and DFSI, I look forward to meeting you and understanding your goals and needs.

As a professional in the field of insurance and investments, my understanding of people's goals and aspirations has created a lasting bond over two decades. The key to their success has been my passion for excellence.