Charitable Giving

Five Reasons To Give To Charity

Donating to the causes you care about not only benefits the charities themselves, it can be deeply rewarding for you too. Millions of people give to charity on a regular basis to support causes they believe in, as well as for the positive effect it has on their own lives.

So why is giving to charity so gratifying? We’ve taken a closer look at five reasons to donate to your charities of choice.

1. Giving To Charity Makes You Feel Good

Donating to charity is a major mood-booster. The knowledge that you’re helping others is hugely empowering and, in turn, can make you feel happier and more fulfilled. Research has identified a link between making a donation to charity and increased activity in the area of the brain that registers pleasure - proving that as the old adage goes, it really is far better to give than to receive.

Research into why people give, supports this. We asked 700 of our generous donors to tell us what motivates them to give regularly to charity; 42% agreed the enjoyment they receive from giving as a key influence.

What type of giver are you?

Check out this U.K. based quiz.

2. Giving To Charity Strengthens Personal Values

Why We Give

In U.K. Based Research, a feeling of social conscience was the most widely-given reason to give to charity. Whatever type of charity work they supported, 96% said they felt they had a moral duty to use what they had to help others, a sentiment very much rooted in their personal values and principles.

Having the power to improve the lives of others is, to many people, a privilege, and one that comes with its own sense of obligation. Acting on these powerful feelings of responsibility is a great way to reinforce our own personal values and feel like we’re living in a way that is true to our own ethical beliefs.

3. Giving Is More Impactful Than Ever

Many people are concerned that their donations to charity may be reduced by tax or administrative costs, preventing the full amount from reaching the people or causes they really want to help. Thankfully there are ways to make the most of every donation to charity.

There are many other ways to give to charity tax-effectively too, such as by donating straight from your salary, donating shares to charity or leaving a charitable legacy in your Will. These methods of giving ensure your chosen charities benefit as much as possible from your support.

4. Giving To Charity Introduces Your Children To The Importance Of Generosity

Sharing the experience of donating to charity with your children shows them from a young age that they can make positive changes in the world. Children naturally love to help others, so nurturing their innate generosity is likely to mean that they grow up with a greater appreciation of what they have, and will carry on supporting charity in years to come.

Starting a tradition of donating to charity with your children is easy - try creating a family donation box that everyone can add to and nominate a family charity each year, involving the children in choosing which causes to support.

5. Giving To Charity Encourages Friends And Family To Do The Same

Your own charitable donations can inspire your nearest and dearest to give to causes important to them, and could even bring about a family-wide effort to back a charity or charities that have special significance to you as a group.

Family giving creates a bond, helping to bolster relationships through a shared goal and raising more money than could otherwise be possible through individual donations. Chances are, many of your family members are already giving to charity, so working together could help you to make even more of a positive impact. We can help your family to set up a family trust to make coordinating your donations simple and sustainable.

If this has inspired you to make a donation to charity, we can help. We make it easy to find a charity that’s working for causes important to you; whether you want to make a one-off donation, set up a donation plan or find out how to donate your time.

Start Giving Today!

The Giving Report 2022: Online Giving Is at Crossroads

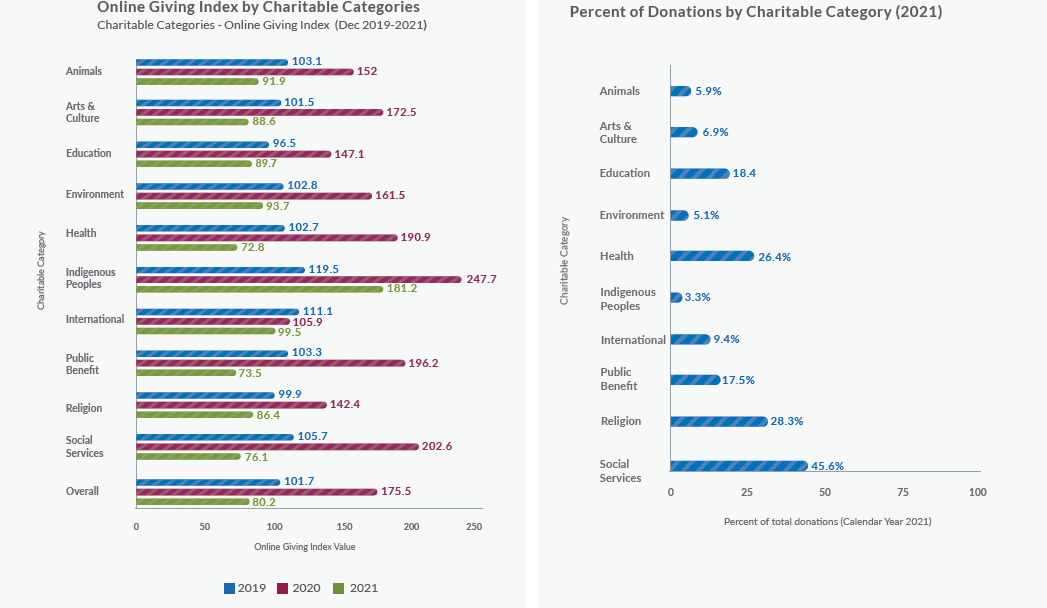

Since 2017, The Giving Report, CanadaHelps has provided knowledge and insights to help Canadians understand the charitable sector and its impact on Canada. The 2020 report introduced our Online Giving Index (OGI), drawing on CanadaHelps’ unique volume and breadth of Canadian data about online charitable giving. The OGI reveals insights about the growth of online giving in Canada.

Our last three reports have shed light on what we consider the most concerning trend: the giving gap, a term used to discuss the steady decline in the percentage of Canadians that donate to charities, the increased reliance on a smaller group of aging donors, and the funding shortfalls charities from coast to coast will face when these donors can no longer give.

The giving gap continues to widen. Across generations, how we think and support charities and causes is different. Looking at younger Canadians, there is hope - today, they have the intention to give in the future.

This concerning outlook is supported by the declining growth seen in online giving since March 2021. Moreover, our research also shows that four out of five Canadians expect inflation and/or the prolonged impacts of the pandemic will negatively impact their financial situation. As a result, one in four Canadians (26%) expect to use or are already using charitable services in 2022, and one in four Canadians (25%) expect to give less in 2022 than they did in 2021. While we see hope that younger Canadians are engaged and will in time give, the need is urgent and all Canadians must step up.

While troubling declines in giving continue and there remain concerning giving gaps, there are a number of positive trends found in this year’s report.

Five years ago, I introduced the first edition of The Giving Report, an annual report that provides Canadians, charities, and businesses with critical insights on the role of the charitable sector,its health, and emerging giving trends. Each year, the report engages more Canadians, and I am proud of the coverage received in media, large and small, that helps advance important conversations about the well-being of our country.

However, as I introduce our fifth annual report, my concerns for the future of Canadian charities and the resulting strength of our communities is more heightened than ever.

By Marina Glogovac, President and CEO, CanadaHelp

The charitable sector is a major employer, accounting for 10% of the full-time Canadian workforce.

Online giving is growing at three times the rate of overall giving.

Donations to international and Indigenous charities have both seen higher than average growth.

How It Works In Canada

The Mackenzie Charitable Giving Program is offered through the Strategic Charitable Giving Foundation, a non-profit charitable corporation. As with any registered charity, donations are irrevocable; however, the donor retains the right to advise the Foundation on which charities receive annual grants and to name successors who may offer direction in their place. For this reason, the program is known as a “donor-advised program.”

-

An account is established with an initial donation of $10,000 or more in cash, stocks, bonds, mutual funds, or insurance – all of which is eligible for a donation tax receipt.

-

The donor names their account. Every time a grant is sent to a charity, the fund's name is cited as the source of the gift. Donors may also choose to donate anonymously.

-

Account is administered under the Strategic Charitable Giving Foundation.

-

Donations are invested in a conservative investment selected by the donor, as an agent of the Strategic Charitable Giving Foundation and managed by Mackenzie Investments.

-

The donor selects an annual donation rate between 4 and 100%.

Investment Options

Donations to the Mackenzie Charitable Giving Program can be invested in any one of 13 funds, offering the potential for donations to grow and ultimately result in additional dollars to charities over time.

Managed Assets and Private Wealth Pools.

Make a difference today…. learn more about the benefits of the Mackenzie Charitable Giving Program.

Resources

Government of Canada

Charities and Giving

Other resources

Tax Savings Calculator

Donation of Securities Calculator

Charitable Giving Tax Credit Calculator

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

This should not be construed to be legal or tax advice, as each client’s situation is different. Please consult your own legal and tax advisor.

Mackenzie developed the Mackenzie Charitable Giving Fund program with the Strategic Charitable Giving Foundation, a registered Canadian charity. Donations under the program are irrevocable and vest with the Foundation. The information is general in nature and is not intended to be professional tax advice. Each donor’s situation is unique, and advice should be received from a financial planner. Please read the program guide for complete program details, including fees and expenses, before donating.

The payment of distributions is not guaranteed and may fluctuate. The payment of distributions should not be confused with a fund’s performance, rate of return or yield. If distributions paid by the fund are greater than the performance of the fund, your original investment will shrink.

Distributions paid as a result of capital gains realized by a fund, and income and dividends earned by a fund are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Contact us today to make charitable giving work for you.

*Mutual funds distributed through Desjardins Financial Security Investments Inc.

As a financial planner at DFSIN and DFSI, I look forward to meeting you and understanding your goals and needs.

As a professional in the field of insurance and investments, my understanding of people's goals and aspirations has created a lasting bond over two decades. The key to their success has been my passion for excellence.