Ethical Investing

Sustainable investing: Common myths and misconceptions - Part 1

INVESTMENT VIEWS

POSTED BY EMPIRE LIFE

JUL 7, 2021

Sustainable investing has experienced increased interest over the past few years, with a sharp acceleration in 2020 due to the COVID-19 pandemic and other high profile social issues, such as the Black Lives Matter movement. There are, however, some common myths and misconceptions among investors that may be new to modern sustainable investing approaches. This educational resource attempts to provide insight and clarification into what we believe are the most misunderstood issues.

Myth #1: Sustainable investing is the same as ethical investing

While modern sustainable investing approaches have their roots in ethical investment strategies, there are important differences. Traditional ethical investing (also known as socially responsible investing, or SRI) is just one approach to sustainable investing, and typically involves strategies that prohibit investments in companies involved in certain industries that are considered unethical. Some of the more common areas of involvement include tobacco, firearms, controversial weapons, adult entertainment, and gambling, however, there are many others. These areas of involvement are highly subjective in nature, since different individuals will have different views of what they personally believe are “wrong”. Additionally, these exclusions may not involve factors that are financially material (particularly in those legacy strategies) and tend to focus only on social issues.

On the other hand, many modern sustainable investing approaches focus on financially material environmental, social, and governance (ESG) factors. Since they account for the materiality (or economic impact) of these ESG factors, they are typically less subjective than traditional SRI approaches.

Advancements in reporting standards over the past few years and increasing investor demand for better ESG transparency has facilitated this shift in focus towards materiality. Lastly, the incorporation of material ESG factors into the investment process may not only help to identify material ESG related risks, but also uncover material ESG related opportunities. Modern sustainable investment approaches are where economic value intersects with society’s values (to varying degrees depending on the approach).

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing. Performance histories are not indicative of future performance.

This article reflects the views of Empire Life as of the date published. The information in this article is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

July 2021

Sustainable investing: Common myths and misconceptions - Part 2

POSTED BY EMPIRE LIFE

JULY 14, 2021

Myth #2: All sustainable investing approaches are essentially the same

It is vital in understanding the different approaches related to sustainable investing. While standards and definitions continually evolve,

there are generally six approaches to sustainable investing. Depending on an investor’s motivation in considering sustainable investing,

some approaches may be more relevant than others.

In very general terms, the approaches further down the list imply a shift in balance towards societal values and less emphasis on economic value.

- ESG Incorporation relates to the consideration of material ESG factors in the investment decision making process. For asset managers, this can be achieved within any of the three broad stages of the investment process: defining the investable universe, security level analysis, and portfolio construction. The primary goal of this approach is to improve longer term risk-adjusted returns.

- Positive/Best In Class Screening focuses on companies and issuers that perform better than peers on one or more ESG related risk metrics. Similar to ESG incorporation, the primary goal is to improve longer term

risk-adjusted returns. - Negative/Exclusionary Screening excludes securities, issuers, or companies from a specific investment strategy based on certain ESG-related activities, business practices, or business segments. The traditional SRI

strategies discussed above typically fall into this approach, but negative screening may

also be considered a modern approach if the focus is on financially material ESG factors.

- Active Ownership and Engagement uses rights and position of ownership to influence issuers’ or companies’ activities or behaviors. Direct engagement is typically more successful for larger asset management firms controlling larger blocks of a company’s shares. Smaller investors can join collaborative engagement groups to aggregate their influence. Goals are to influence a company’s ESG related activities or to improve transparency in ESG factor reporting.

These approaches are not mutually exclusive and a product/strategy may employ more than one approach.

They also typically complement traditional financial analysis and should not be considered a replacement.

Empire Life Global Sustainable Equity GIF uses ESG incorporation and a best-in-class approach.

Read more about Empire Life's ESG philosophy.

Related articles:

Sustainable investing: Common myths and misconceptions

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered.

Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value.

Please read the information folder, contract and fund facts before investing. Performance histories are not indicative of future performance.

This article reflects the views of Empire Life as of the date published.

The information in this article is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice.

The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document.

Please seek professional advice before making any decisions.

July 2021

Sustainable investing: Common myths and misconceptions - Part 3

POSTED BY EMPIRE LIFE

JULY 21, 2021

From an evidence point of view, the proliferation of sustainable investment strategies and strong fund flows into these products are easily researched through publicly available resources. Underlying these trends, however, is a more durable structural shift.

Myth #3: Sustainable investing is a fad

There is an increasing acceptance among asset managers that ESG factors have a material impact on the longer term valuation of investee companies, and it is an asset manager’s fiduciary responsibility to consider all material factors. In the past an impediment against this structural shift was the lack of consistent and meaningful ESG data, standards, and aligned frameworks to conduct proper ESG analysis. That argument is being gradually nullified as investors continue pressuring companies to report on ESG related factors that are aligned with increasingly accepted frameworks such as SASB (Sustainable Accounting Standards Board), TCFD (Task Force on Climate Related Financial Disclosures), and IRIS+ (the generally accepted system for impact investors to measure, manage, and optimize their impact). There remains plenty of room for improvement in this area, but the quality of data is rapidly improving.

Contact us today to learn more about Socially Responsible Investing.

At Empire Life, we believe sustainable investing is here to stay. We believe that corporate responsibility and a sustainable approach to business operations is a hallmark of quality. We also believe that strong corporate governance aligns management and shareholder interests, and that analyzing environmental and social factors can assist in identifying business models that may create sustainable value while reducing risk. Ultimately, we believe consideration of ESG factors are well on their way to becoming table stakes and “Sustainable Investing” will eventually be synonymous with “Investing” in general.

The recent launch of the Empire Life Global

The recent launch of the Empire Life Global

Sustainable Equity GIF is our debut offering incorporating a structural approach to ESG considerations. It adopts best-in-class screening and ESG incorporation as its main sustainability approaches, layered on top of our deep understanding of what makes a quality business an attractive investment. We believe this balanced approach between value and values represents the most natural progression of investment options within our diverse segregated fund family.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing. Performance histories are not indicative of future performance.

This article reflects the views of Empire Life as of the date published. The information in this article is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

July 2021

Sustainable Investing - The Time is Now

INVESTMENT VIEWS

POSTED BY EMPIRE LIFE

JUL 28, 2021

Highlights:

- Strong sustainable investing interest in the current environment

- Record fund flows into Canadian sustainable investment funds

- Wide interest/usage gap and demographic factors allude to potential for greater fund flows

- Discussion and education will be important drivers going forward

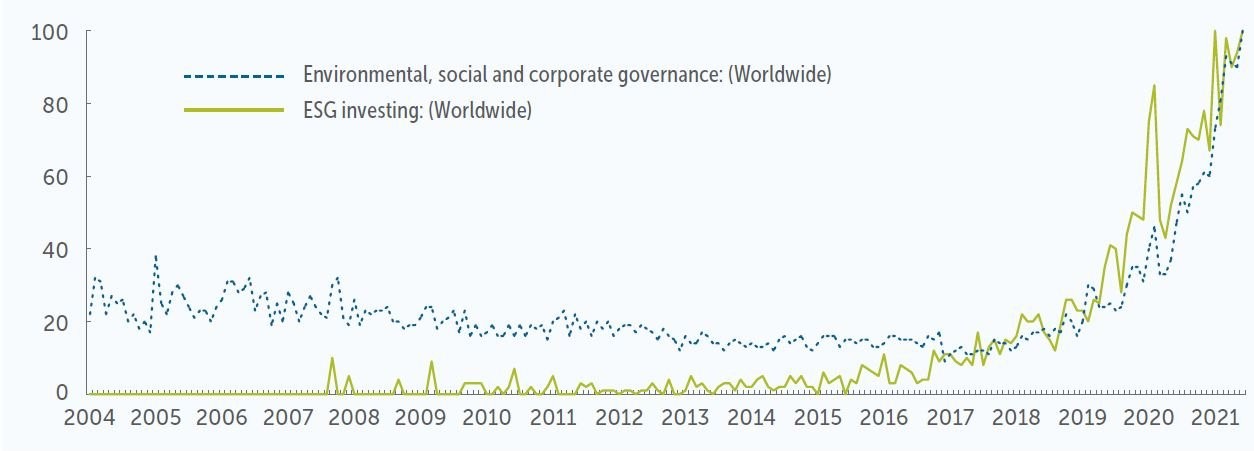

Sustainable investing (often referred to as ESG investing) generally refers to approaches incorporating ESG (environmental, social, and governance) factors into the investment management process. Interest in these approaches has exploded in recent years. According to Google Trends, global interest in ESG investing is at its highest level over the longest observable period.

Google trends: Relative interest over time

Source: Google Trends, January 2004 - June 2021. Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means the term is half as popular. A score of 0 means there was not enough data for this term.

Arguably, climate change is considered the initial driver of interest in sustainable investing. However, the onset of the COVID-19 pandemic in early 2020 sharply accelerated the trend as an increased focus on social issues took hold. First, the scramble for PPE (personal protective equipment) put a spotlight on access to health care equipment when countries with manufacturing capabilities blocked exports of these critical items to ensure their own citizens were protected first. As economies locked down to prevent virus spread, workers in the lower-paying hospitality and tourism industries were disproportionately affected with job losses, while many professionals simply shifted to working from home. Essential workers in congregate care settings, food processing, and distribution centers were disproportionately exposed to workplace safety issues with virus outbreaks at their places of employment. And now the richest countries hoard vaccine supply for their own populations, again limiting global access to health care.

On another developing front, public companies are seeing increased pressure from shareholders and the courts to act more strongly on sustainability factors. May 2021 provided a prime example when three energy companies were subject to high-profile events relating to climate action. First, in the Netherlands, a court ruling against Royal Dutch Shell ordered the company to reduce their (and their suppliers and customers) CO2 emissions by a net 40% by 2030, compared to 2019 levels. The company’s previously announced carbon reduction goal was to reduce the carbon intensity of its energy products by 20% by 2030. The second event was a shareholder vote at ExxonMobil, where an activist investor won three director seats on the company’s twelve-member board. They were put forth to help Exxon’s longer-term value creation by addressing more disciplined capital allocations, an incentive policy better aligned with shareholder value, and in its transition to compete in a lower-carbon economy. The final event was at Chevron, where shareholders voted in favour of reducing the company’s Scope 3 emissions1, which was a vote against management’s recommendation.

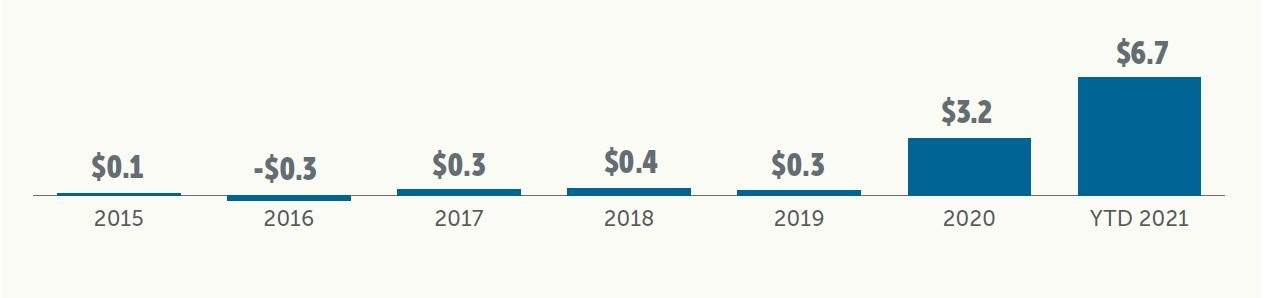

Evidence of the increased interest in sustainable investing can be seen in fund flows into Canadian domiciled sustainable investment funds (mutual funds, ETF’s, segregated funds). Fund flows in 2020 more than tripled those reported in the preceding five years COMBINED, and the parabolic trend continued into the first five months of 2021 alone, which more than doubled fund flows reported in all of 2020.

Contact us today to understand Sustainable Investing.

Estimated Canadian fund flows

(billions $CAD)

Source: Morningstar Research Inc., as at May 31, 2021 - excludes fund of funds

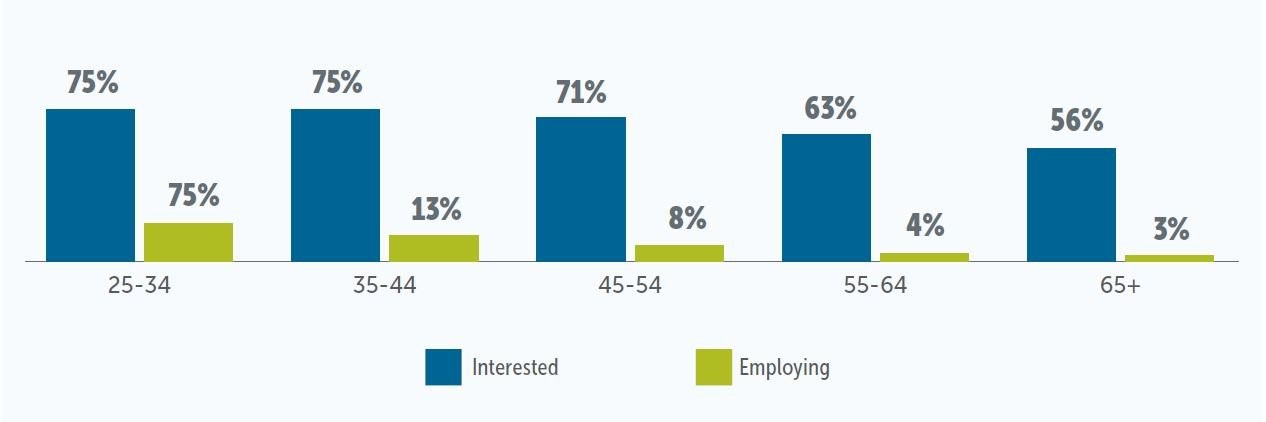

Despite the growth in fund flows, evidence suggests these trends could be much stronger due to a significant interest/usage gap. A 2020 research report by the CFA Institute2 reveals that among global investors, interest in sustainable solutions far exceeds actual usage across age groups. With usage gaps (% interest minus % employing) consistently in the 53%-63% range, this represents a great deal of untapped potential for sustainable investment solutions.

Percentage of investors interested/employing sustainable strategies by age group

A very similar dynamic holds true among Canadian investors. According to the Responsible Investment Association (RIA) , 73% of investors surveyed indicated an interest in sustainable investments, however, only 33% employed sustainable strategies. Among younger investors (aged 18-34) 83% expressed interest and only 50% employed sustainable strategies, while in older groups (aged 55+) the results were 59% and 20%, respectively.

As noted previously, there is a higher level of interest in sustainability among younger investors. Not a surprising view, considering younger populations will likely bear the brunt of climate change’s impact on their quality of life. They are more willing to act now to prevent the “tragedy of the horizon”, a term coined by the former Bank of Canada (and Bank of England) Governor Mark Carney. The term refers to the timing of climate change’s devastating effects being beyond the time horizon global leaders typically consider when making policy decisions. However, when it is close enough to be considered a threat within their policy window, it will likely be too late.

Combining this younger demographic’s views with the ongoing intergenerational transfer of wealth, demand for sustainable investment products may further explode. According to Investor Economics3, an estimated $1 trillion of wealth will be transferred from Baby Boomers to younger generations by the year 2026 in Canada.

What does sustainable investing look like?

Sustainable investing today is no longer about just avoiding companies considered to be involved in areas considered unethical. That was in the past. It is now about realizing that environmental, social, and governance factors can have a real impact on the value of an investment and on one’s portfolio. It is also about directing capital towards companies and opportunities that may foster positive change for all. It is a shift in mentality that considers profits, people, and the planet. Advisors and financial institutions that are not aligned with this evolution in investor demographics and priorities may see their business prospects significantly affected.

1. Scope 3 emissions are indirect emissions from sources not owned by the company - for example when gasoline is burned by their customers

2. Future of Sustainability In Investment Management: From Ideas to Reality (2020)

3. 2019 Investor Economics Household Balance Sheet Report

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing. Performance histories are not indicative of future performance.

This content reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

July 2021

As a financial planner at DFSIN and DFSI, I look forward to meeting you and understanding your goals and needs.

As a professional in the field of insurance and investments, my understanding of people's goals and aspirations has created a lasting bond over two decades. The key to their success has been my passion for excellence.