Mortgage Insurance

Mortgage Insurance should never be underestimated

Mortgage Insurance through your Bank? Why you may not be as protected as you think.

Are You Really Protected?

As a proud home owner like most Canadians, your home is the centre of your family and social life.

Once all the fees, expenses, legalities are settled, have you thought of how your family would manage the mortgage payments in event of death or critical illness.

Your home is your most important investment. Makes sense to keep it secure for your family. Many Canadians aren’t familiar with how mortgage insurance works or the full extent of its coverage, leaving you vulnerable.

Did you first hear about mortgage insurance from your lender during the mortgage application process? Often presented as an easy to approve, affordable solution to pay off the debt in case of death or critical illness allowing your family to remain in your home.

Unfortunately, This is Not Always the Case

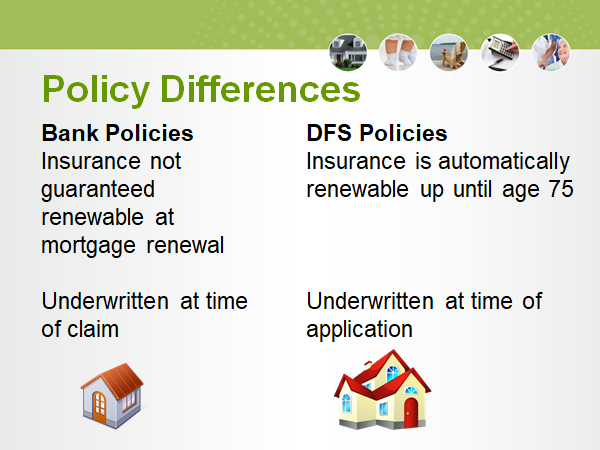

Banks don't determine if you are qualified for mortgage insurance at the time of your application. They decide after a claim has been made through POST-CLAIM underwriting. Any discrepancies on your application, your claim could be DENIED!

Ensure you obtain the right coverage.

A home will probably be the largest single investment in your lifetime. It's a valuable asset....

You insure valuables with fire and contents insurance whereas YOUR MORTGAGE IS YOUR LARGEST DEBT!

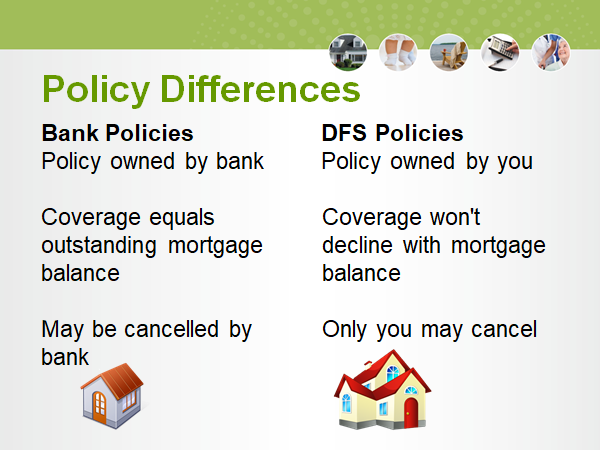

- With mortgage insurance from a bank, you have level premium payments but declining insurance coverage.

- Not so if your insurance is protected by Desjardins.

- The insurance value does not reduce with your mortgage.

- Your premiums remain level as your mortgage reduces.

- Adding value to your insurance for your beneficiaries.

Ensure you obtain the right coverage.

Is Mortgage Your Largest Debt....?

Is your home your most valuable asset....largest single investment ?

Insurance protects your losses:

PROTECTION – Home and contents insurance, fire insurance, car insurance, liability insurance – Keeps you and your family safe.

MORTGAGE INSURANCE – Keeps your home safe for your family.

Desjardin Financial Services vs. Banks

MORTGAGE INSURANCE FROM AN INSURANCE COMPANY:

- Your premiums remain level as your MORTGAGE REDUCES.

- Your LIFE INSURANCE does NOT reduce with your mortgage.

- Your insurance pays out to your BENEFICIARIES.

- MORE insurance for your beneficiaries on death.

- MORE VALUE after mortgage payment!

MORTGAGE INSURANCE FROM A BANK:

- Your premiums remain level BUT your INSURANCE REDUCES.

- Your LIFE INSURANCE reduces with your mortgage.

- Your insurance pays out your mortgage ONLY.

- NO insurance for your beneficiaries on death.

- NO VALUE after mortgage payment!

Are you really protected with BANK INSURANCE?

Do you know how mortgage insurance works - Banks vs Insurance Company? Many Canadians are not familiar with how mortgage insurance works or the full extent of the coverage.

Is your home your most valuable asset?

Once all the fees, expenses, legalities are settled are you sure your family would manage the MORTGAGE payments in the event of your death or critical illness?

Makes sense to keep it secure for your family.

Mortgage insurance from an Insurance Company.

~You ARE as protected as you think:

- Banks do not qualify you at the time of your application.

- Insurance Company UNDERWRITES your insurance at application.

- Banks decide after a claim – POST-CLAIM UNDERWRITING.

- Insurance Company assures your Life Insurance, once taken.

- Banks can deny your CLAIM if not satisfied, after it is taken.

At a time of grief you do not need financial stress!

Desjardins Financial Services vs Banks

Do you own your mortgage insurance or does the bank own it?

Will your beneficiaries get your insurance after your mortgage is settled with the bank?

Desjardins Financial Services vs Banks

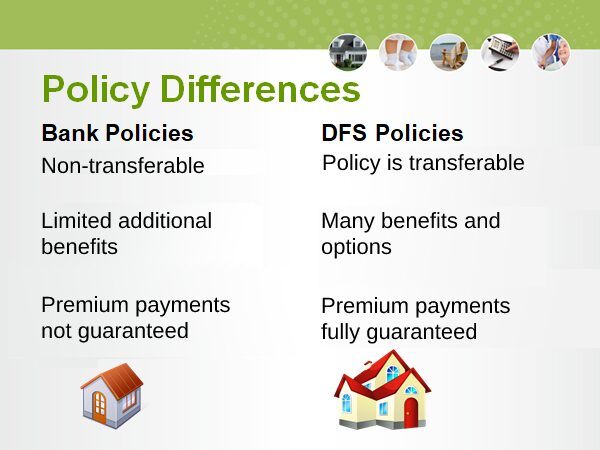

Are your premiums guaranteed or are you in for surprises?

Can you transfer your policy on refinancing? Or do you have to get a new life insurance with a new lender, at a higher cost?

Desjardins Financial Services vs Banks

Is your policy guaranteed renewable? Is it underwritten at the time of application...or at claim?

Can you be sure the insurance claim will not be denied to your beneficiaries?

Contact us today to discuss your Mortgage Insurance.

As a financial planner at DFSIN and DFSI, I look forward to meeting you and understanding your goals and needs.

As a professional in the field of insurance and investments, my understanding of people's goals and aspirations has created a lasting bond over two decades. The key to their success has been my passion for excellence.